What is a home loan pre-approval and how to get one?

Buying a home is not just about home appreciation. Home ownership gives you tax benefits, and counts as a major asset for building wealth. Before you enter the competitive home-buying market, however, it’s best to have a mortgage pre-approval in hand in order to show that you are a serious buyer.

In this article, you will learn how to breakdown mortgage payments, what is a mortgage pre-approval and how to get one.

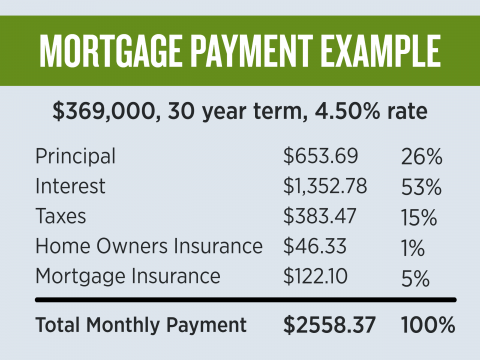

Calculating mortgage payment: PITI

Before going into the mortgage pre-approval process, you need to understand the payments first. For first-time home buyers especially, mortgage payments can seem complicated and confusing.

You might have heard of the term PITI. PITI is an acronym that stands for the four elements included in a monthly mortgage payment:

Principal – The original amount you borrowed, before any interest. For example, if you buy a home that costs $500,000 with a 20% down payment, you pay $100,000 and you owe $400,000. The $400,000 is the principal amount.

Interest – Essentially the monthly fee you pay for the loan, determined by the interest rate. For example, if you borrow $100,000 with a 4% annual interest rate, you pay $4000 for the first year in interest. For fixed-rate mortgages, the interest rate is fixed for the life of the loan. There are also adjustable-rate mortgages, which means the interest rate will change under certain conditions.

Check current mortgage interest rates: Aquila Standard Daily Rate Sheet

Taxes – The amount of property taxes you need to pay depends on which county the property is located in, and it also varies from year to year. Generally, expect to pay 0.1% of your home’s value every month.

Insurance – Most mortgage lenders require you to maintain a certain level of property insurance. Homeowners insurance protects the property from disasters such as fire and theft.

If your down payment is less than 20%, you are often required to pay for private mortgage insurance (PMI). This insurance protects the lender in the event of loan default.

Use our mortgage payment calculator to help you plan for your future home purchase, or use the loan comparison calculator to compare two different home loans.

What is a home loan pre-approval?

If you are ready to take the responsibility of the monthly mortgage payments, you might want to go ahead and get pre-approved for a home loan. With a pre-approval in hand, you can show sellers and agents that you are able to afford the home. In fact, many real estate agents won’t even take you to home tours unless you have a pre-approval.

The pre-approved mortgage amount is based on your income, credit, and assets. You should have a stable income, a good credit history, and enough assets to pay for the down payment and closing costs.

How to get pre-approved for a home loan?

In order to get a mortgage pre-approval, these are the documents typically required by lenders:

- W-2 forms and federal income tax returns for the last 2 years

- Paycheck stubs covering last 30 days

- 2 most recent monthly statements for any checking, savings, or other financial accounts

- Verification of other income or assets (e.g. social security, retirement, stocks, 401K, etc.)

We will contact you to let you know what specific documents we will need from you in order to verify your income and assets.

How long does it take to get pre-approved for a mortgage?

Roughly a week. Once we get the mortgage pre-approval application online, it takes us 24-48 hours to review and request relevant documents from you, which can take anywhere from 24-72 hours depending on what documents are needed and our capacity.

How long does a mortgage pre-approval last?

Aquila Standard’s home loan pre-approval letter is good for 120 days. Other lenders might have different time limits, such as 30 or 60 days. If you cannot find the right home in 120 days, we can always collect updated information and extend the pre-approval for you.

Having a pre-approval can be the difference between having the winning offer on your next house and watching some other family move into your dream home.

P.S. Aquila Standard doesn’t charge pre-approval fees.