Is Zero-Percent Financing Too Good To Be True?

Many auto manufacturers have had a tough time weathering the economic storm of the past couple of years. We are starting to see things turn around which is translating into an upward trend in auto prices and rates, but there are still manufacturers offering 0% financing to entice buyers to visit their dealerships. Zero-percent financing may look pretty tempting, but is it really a good deal?

The truth is, getting an auto loan at 0% is very difficult; very few auto buyers actually qualify. Most of these financing plans require a minimum credit score of 750 and apply only to certain cars at the dealership, not the entire stock. Zero-percent loans also typically offer shorter terms, 36 months instead of 60, which means the monthly payment will be considerably higher and out of the price range of the average, debt-ridden American. In many cases, qualifying for 0% also means forgoing any manufacturer rebates that may have been associated with the sale.

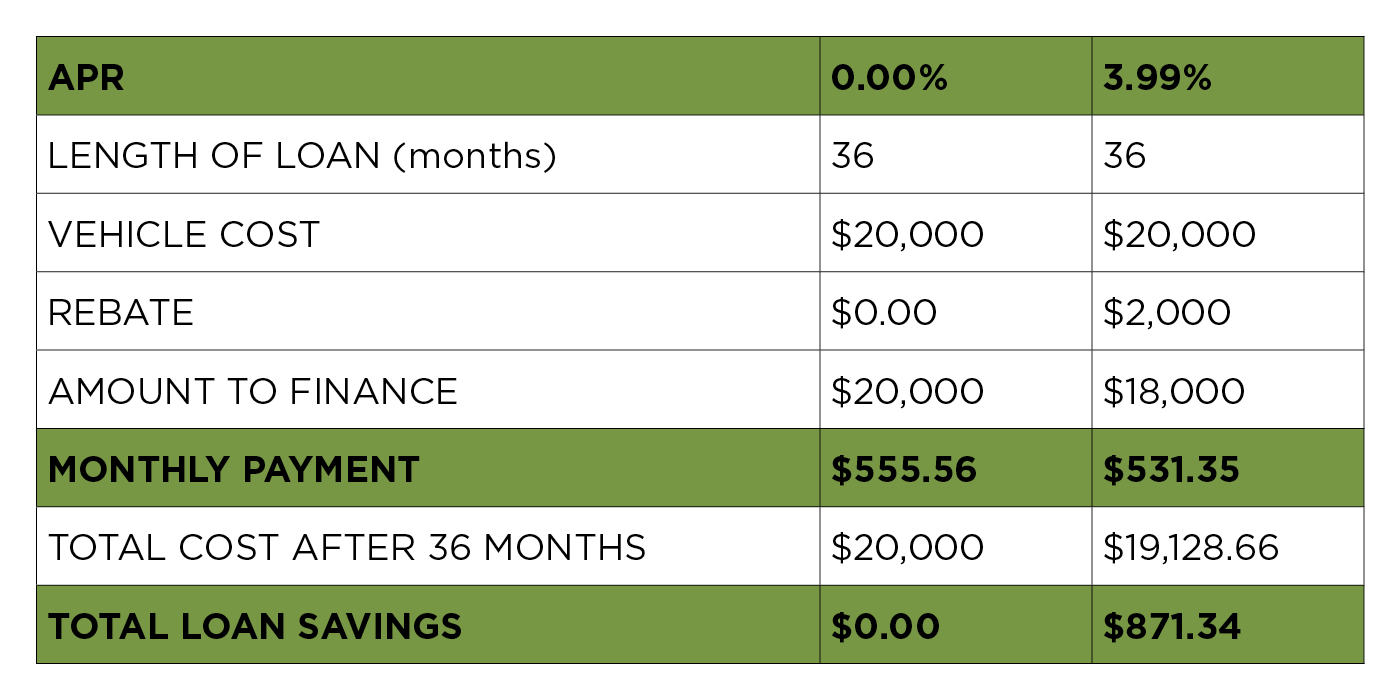

So, back to the question at hand. Qualification aside, is zero-percent financing a good deal? Let’s look at a comparison between 0% and a 3.99% Aquila Standard auto loan with a manufacturer rebate of $2000:

Zero-percent financing deals can work well for those who have a high income and excellent credit—but in most cases 0% really isn’t as great as it appears. Even if you were to stretch that same 3.99% loan over a more traditional 60-month term, you would still come out ahead of its 0% counterpart.

If you do qualify for zero-percent financing and elect to pursue that option, pay attention to the price of the car. Dealers often make up for lost finance charges by raising the price, knowing the buyer will be so thrilled with the zero-percent financing that he/she will forget or overlook they are paying too much for the car.