How to Save For Goals While Repaying Debt

Paying down debt is an overwhelming hurdle for many. But with a little determination and focus, your financial journey can improve.

Track Your Spending

Begin by tracking your typical income and expenses for one month. Once your monthly spending is recorded, use any extra funds to pay down debt and build savings. If you don’t have a surplus, you’ll need to cut expenses.

Grow Your Savings

Every month, use your income to first pay expenses, then dedicate the remaining to savings or reducing your debt. Be sure to save for an emergency fund even if you have debt in order to avoid relying on credit if there’s an emergency or major unexpected expense. Here are some helpful tips:

- Ask your bank to set up two savings accounts that are linked to your checking account. You can utilize one for emergency cash and the second for investments.

- Place only what you need to live on into your checking account.

- Begin building your emergency savings by depositing a portion of each paycheck into your emergency cash savings account.

- The remaining amount should be transferred to your investments account.

- If you find it hard to control your spending when access to your savings is easy, ask your employer about direct deposit to automatically transfer money from your paycheck to savings.

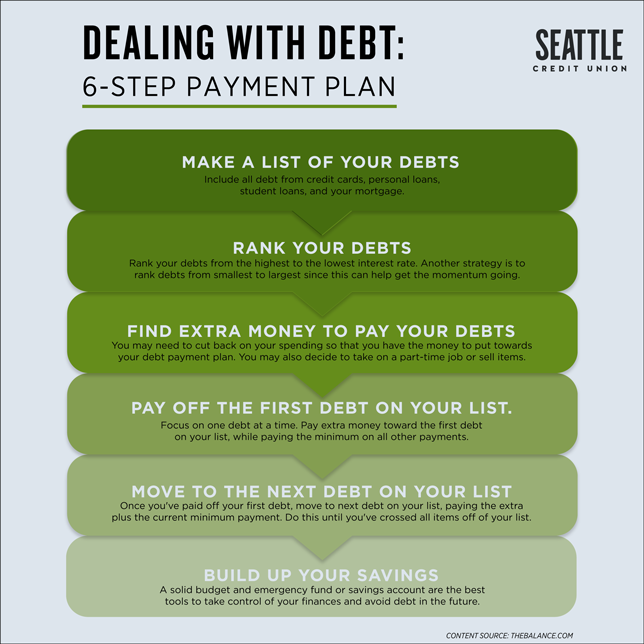

Reduce Your Debt

Next, it’s time to pay down your debt.

- List your debts in order of interest rate, from highest to lowest.

- Add up your liquid assets, including savings and investment accounts, if any.

Determine any major purchases needed in the next year. Subtract this amount from your liquid assets. What remains is the amount you have to pay your debts. Be smart and diligent about paying off your credit cards.

Another important goal to save for is retirement. If your employer provides a retirement savings plan such as a 401k, take advantage of it by contributing a little to your account each month. Keep in mind that while monthly contributions may not seem like much, years of contributions add up – especially if your employer offers to match some of it.

NEED MORE HELP? GET BALANCE, A FREE SERVICE FOR FINANCIAL FITNESS

For a lot of people, becoming financially fit is tough – and even more difficult to maintain. At some point in life, everyone faces financial challenges. Helping you become savvy financial consumers is an important part of why Aquila Standard exists. Whether it’s paying off debt, getting back on track after a financial crisis, or even learning to build a budget to save for important goals like a college education or new home, BALANCE is an ally on the path to financial stability.

BALANCE is a free service for all Aquila Standard members that provides:

- Financial education (articles, webinars, podcasts, newsletters, etc.)

- Resources (income, debt, and loan calculators, toolkits, etc.)

- Access to attorneys

- Coaching from professional, third-party counselors on:

- Debt and budget

- Credit report reviews

- Student loans

- Homeownership

- Bankruptcy

- Services are offered in Spanish both online and over-the-phone.

Check out this free service online or toll free at 888.456.2227 . If you are having difficulty paying off a Aquila Standard loan, please talk with our Member Solutions team at 206.398.5757 . Our team is happy to answer any questions you may have about BALANCE and how it can benefit you become financially fit.