FICO Credit Scores on the Up and Up

Whether you are looking for your first home, refinancing a car, or renting an apartment, understanding your credit score and how to improve your score is beneficial to securing better rates along your financial journey. The average U.S. credit score is the highest it’s ever been at 704, according to FICO, a credit scoring company. If your score does not meet that, don’t worry too much. Your score on average will rise as you age, which makes sense since your credit history plays a factor in your score.

Here are the average scores, broken down by age:

- 18-to-29: 659

- 30-to-39: 677

- 40-to-49: 690

- 50-to-59: 713

- 60 and up: 747

Reasons for higher score

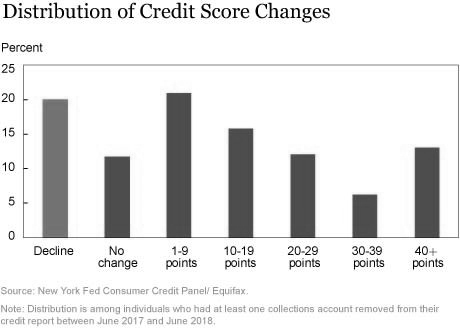

Earlier this year you may have noticed that your score went up. Why the increase? Due to improved standards for utilizing new and existing public records, the three major credit reporting companies (Experian, Equifax, and TransUnion) are now excluding tax liens from credit reports. In addition, scores have been on the rise since the recession in 2009 and can be attributed to fewer consumers having collection accounts dinging their score combined with fewer people seeking credit. Last year marked a four-year low with only 42% of people making one or more hard credit inquiries.

Source: CNBC

Tips to raise your score

- Spread expenses over different cards. The key here is to not go above 30 percent of each card's spending limit and always pay at least the monthly minimum.

- Don't apply for new loans when shopping for your dream home. New credit cards, car loans, or installment loans could temporarily drop your score.

- Avoid closing out credit cards accounts. Even if you're not using the card anymore, it's worth keeping it open and paid off.

- If you are just starting to build credit, ask to have your name added as an authorized user on your parent’s credit card.