7 Ways to Boost Your Credit Score

Creating a positive credit history is important. A poor credit rating can impact your life in ways you may not realize, such as making it harder to rent an apartment or apply for a job. Whether you've had past credit troubles, have yet to establish any credit, or want to get the best rate possible on a loan, follow these tips to help boost your credit score.

What determines your credit score?

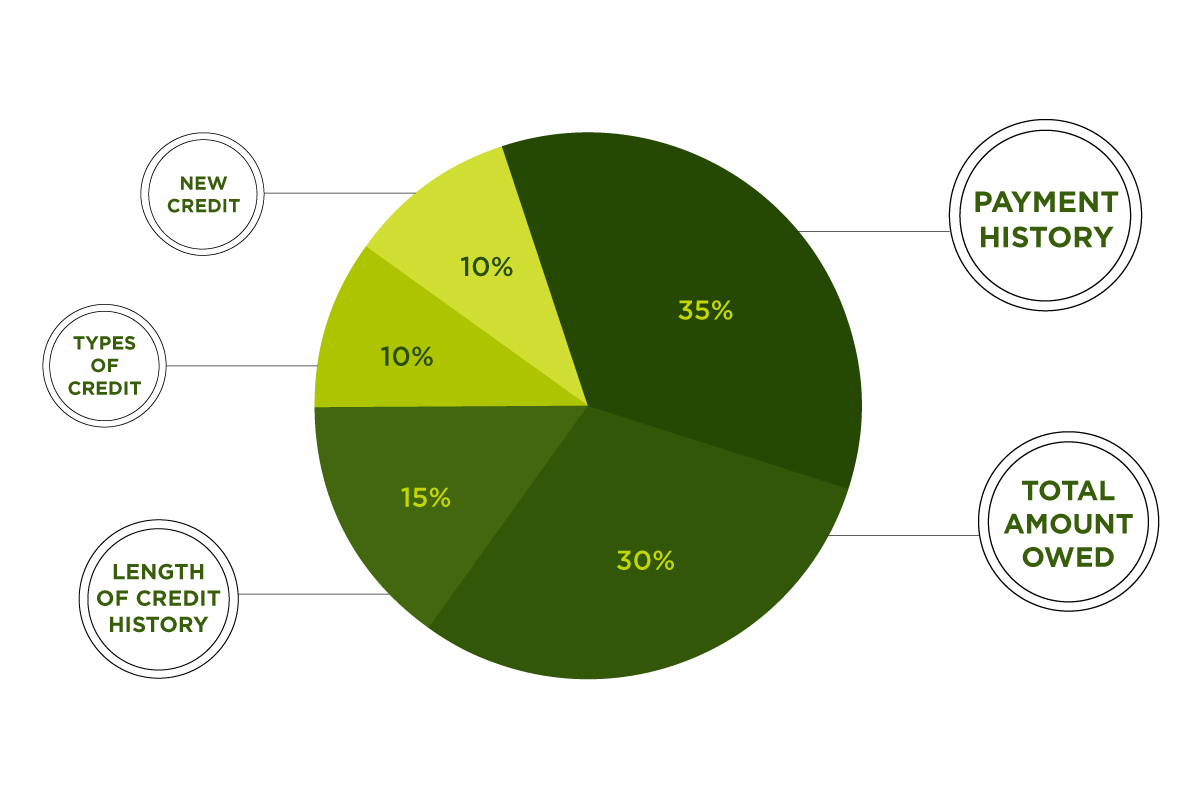

It's helpful to understand the five different components that make up your credit score in order to make changes to maximize it. The weight of each component may vary depending on your credit situation, but the general breakdown* is:

- Payment history accounts for over a third of your FICO Score, making it the most critical component. If you have missed payments, the score formula considers how many you've missed, how late they were, how much was owed, and how recently you missed the payments. Bankruptcies and foreclosures also fall under this category.

- Amounts owed is measured by utilization ratio, which is the percent of your total available credit limit that has been used. For example, if you have total outstanding balances of $1,500 and your combined credit limits total $2,000, your utilization ratio is 75%.

- Length of credit history can raise your credit score, so long as the rest of your report, such as payment history, looks good. This does not mean that you will have a bad credit score if you are a new credit user.

- Applying for new credit can lower your credit score temporarily due to the lender pulling your credit report. It can also raise questions, such as why you need extra funds all of a sudden, particularly if you are a new user of credit.

- The types of credit you use can affect your credit score. Someone who has experience with both revolving credit, such as a credit card, and installment loans, such as an auto loan, may be seen as a more trustworthy borrower.

Here are several ways to boost your credit score:

-

Make payments on time. If you're worried about missing a payment, or even just a fan of convenience, setting up automatic payments using Bill Pay in Online Banking is a great way to ensure you make your payments on time.

If you are struggling to make payments, one option is to refinance your car or home loan to lower your payments. You might also want to speak with a certified debt counselor who can help you make a plan to catch up on your missed payments. Aquila Standard is partnered with BALANCE to provide free debt counseling for members.

-

Reduce debt. This one may be easier said than done, but reducing the amount of debt you have lowers your utilization ratio, which leads to a higher credit score. For a good credit score, keep your credit utilization below 50%. For a great credit score, keep your credit utilization below 30%.

To help control excess spending, create a new budget and stick to it. If swiping your credit card is just too tempting, leave it at home and opt for cash instead.

- It's important to avoid opening multiple credit accounts in a short period of time. This can raise red flags and cause lenders to think you're financially unsound. Additionally, when you apply for a new credit account, the lender pulls your credit report, which lowers your score.

-

Diversify the types of credit you use. Having both an installment loan and a credit card on your report is favorable. You shouldn't buy a car just to have an installment loan on your credit report, but if you're considering financing a large purchase, know that it could improve your credit score.

A person who has a credit card and stays on top of payments is a safer choice than a person who has never had a credit card before. If you don't feel comfortable using a credit card as one of your primary methods of payment, leave it at home. Take it out to make one purchase each month, such as gas or groceries, and pay the bill off in full each month.

- Don't close credit accounts you seldom use all at once. This will cause your utilization ratio to spike. However, having large balances on a large number of accounts also indicates that you are a high-risk borrower, so try to keep moderately low balances among all of your credit accounts.

- Use your credit accounts on a regular basis, even if it's just one small purchase a month. This shows lenders that you are a consistently responsible borrower.

- A great tool to help you build your credit history is Aquila Standard’s Savings-Secured Loan. First, you deposit funds into a designated Aquila Standard account, the same amount that the loan is for. The funds are then frozen until the loan is paid in full, unless you default on the loan, in which case the funds will be used to pay your missed payment. Learn more about Savings-Secured Loans.

*source: http://www.myfico.com/crediteducation/whatsinyourscore.aspx